Get your AIY evidence today for only $50.

Reduce your property taxes. We handle the evidence, you handle the protest.

With appraisal insights and data-driven analytics, AIY is here to provide homeowners with powerful, high-quality protest evidence in minutes.

A solution centered around homeowners

Fast and easy

Enter your address, checkout, and receive your AIY protest evidence directly.

More for you

More savings. More time back.

Empowering you

With AIY you can confidently advocate for yourself.

Why protest your property taxes?

Every increase adds up over time. A 10% increase may not seem like anything today, but over time the yearly increases start to catch up with you. Do something now.

88%

Protest success rate

$6K

Average value reduction

15min

Average time of Protest Hearing

Start saving in 3 steps

Enter your address

AIY will gather your information and compare your notified appraisal against our logic and give you an immediate estimate.

Checkout

Add your searched property to your cart for checkout.

Receive your evidence

Receive your AIY evidence via email immediately after you purchase.

No risk. No worries.

The AIY refund guarantee ensures that you can use our service with confidence. If you are unable to secure a property value reduction, your payment will be fully refunded. Read More about the refund process.

See my savingsFrequently asked questions

How do I interpret AIY evidence?

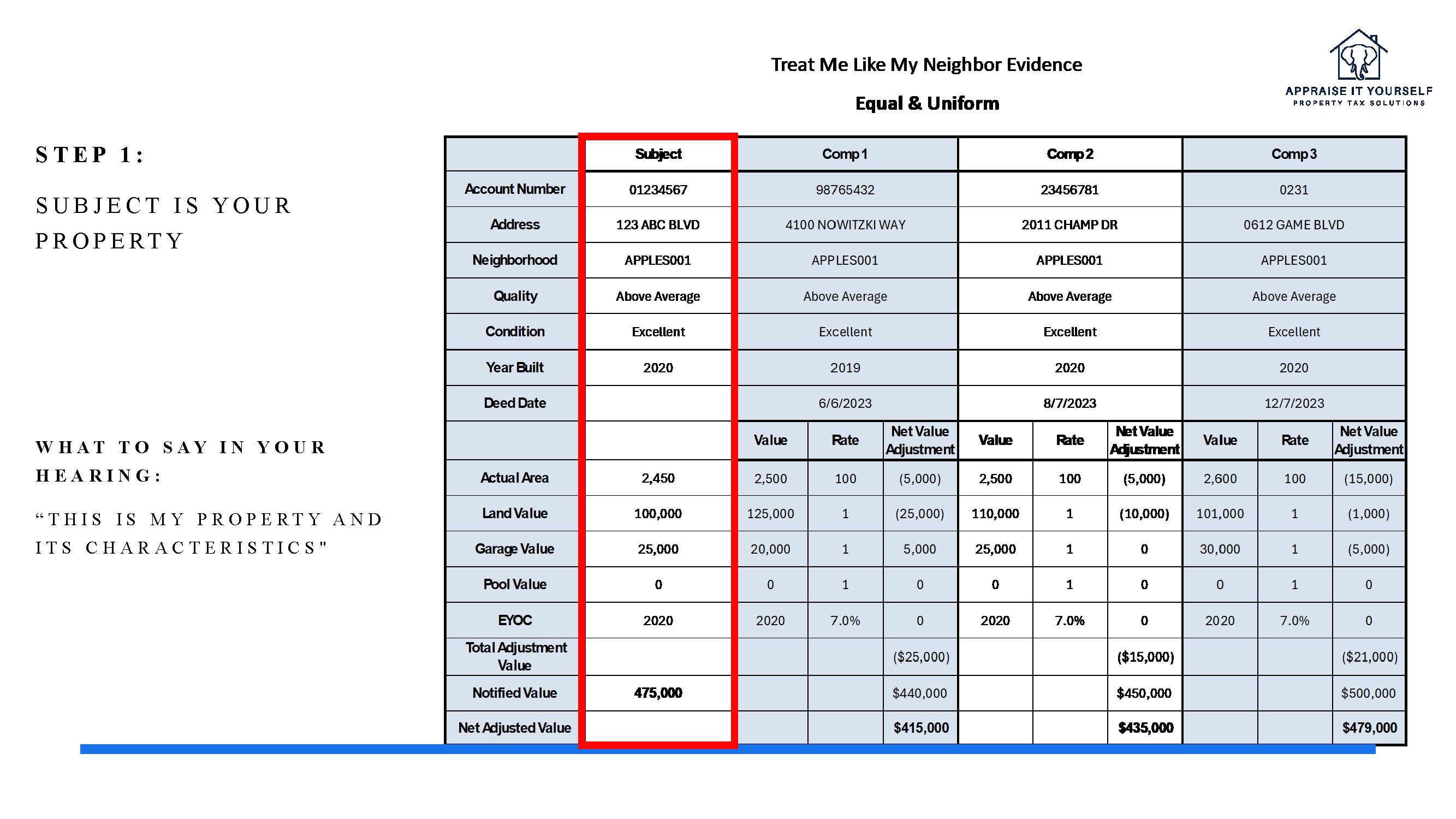

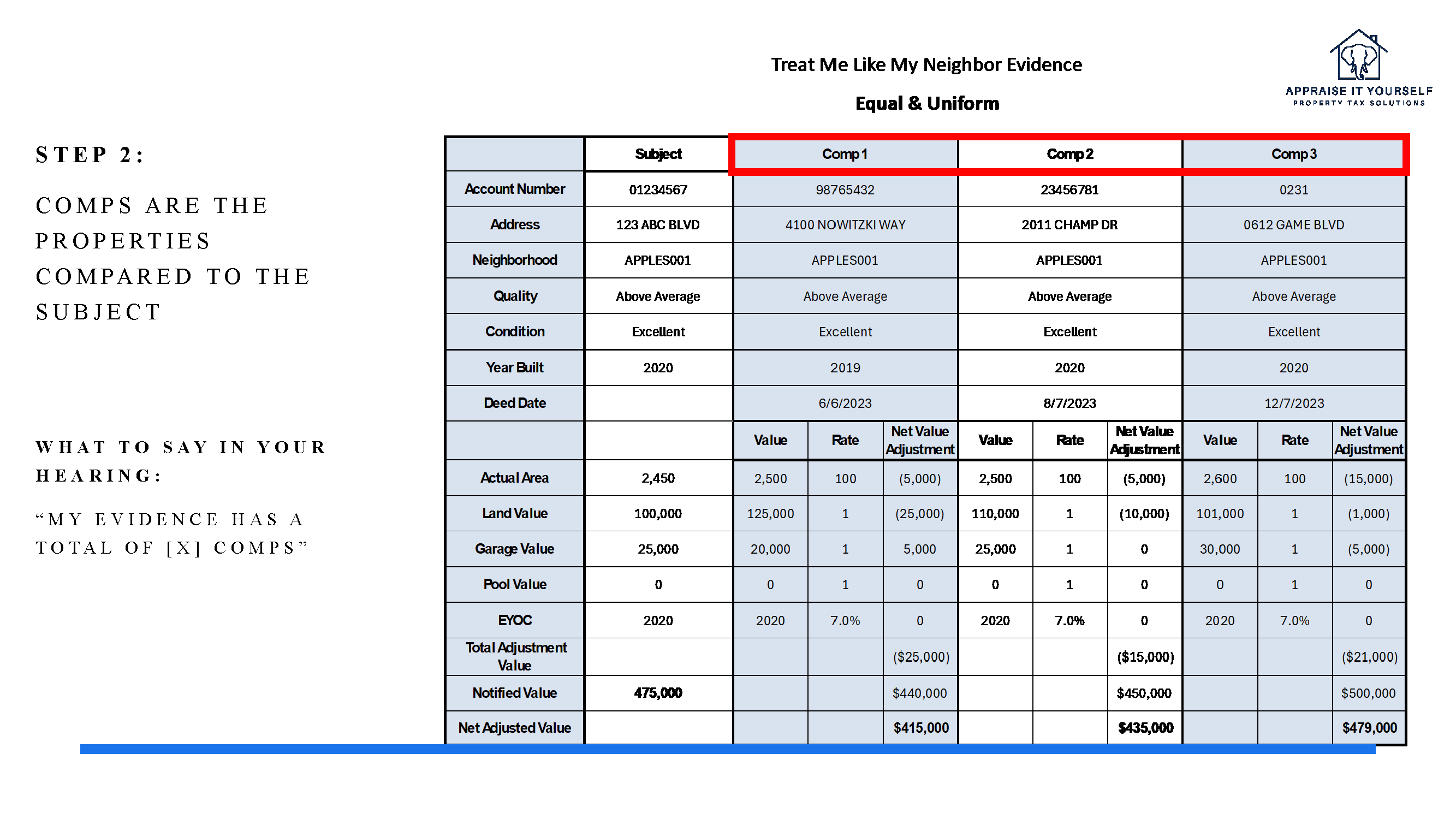

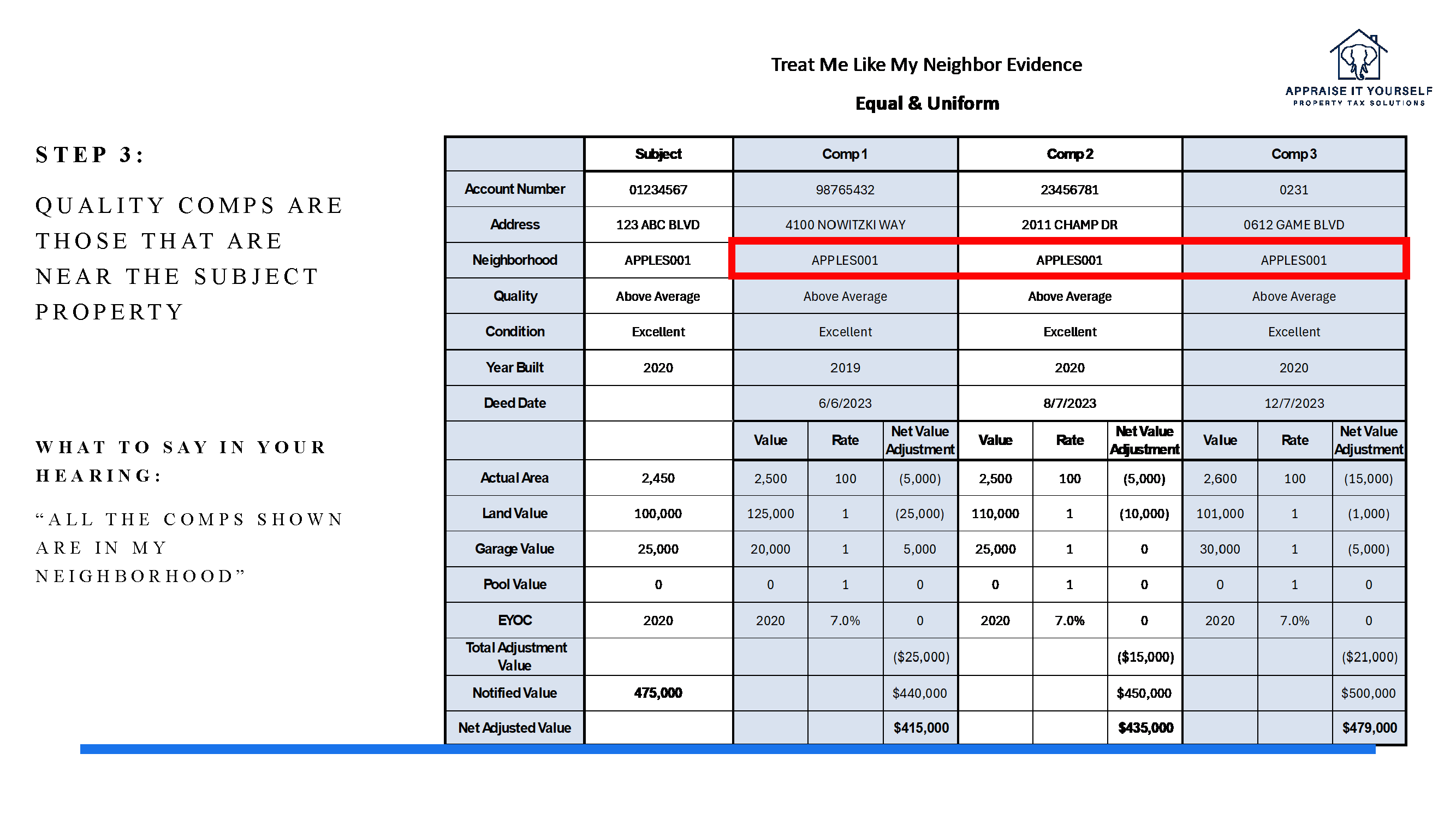

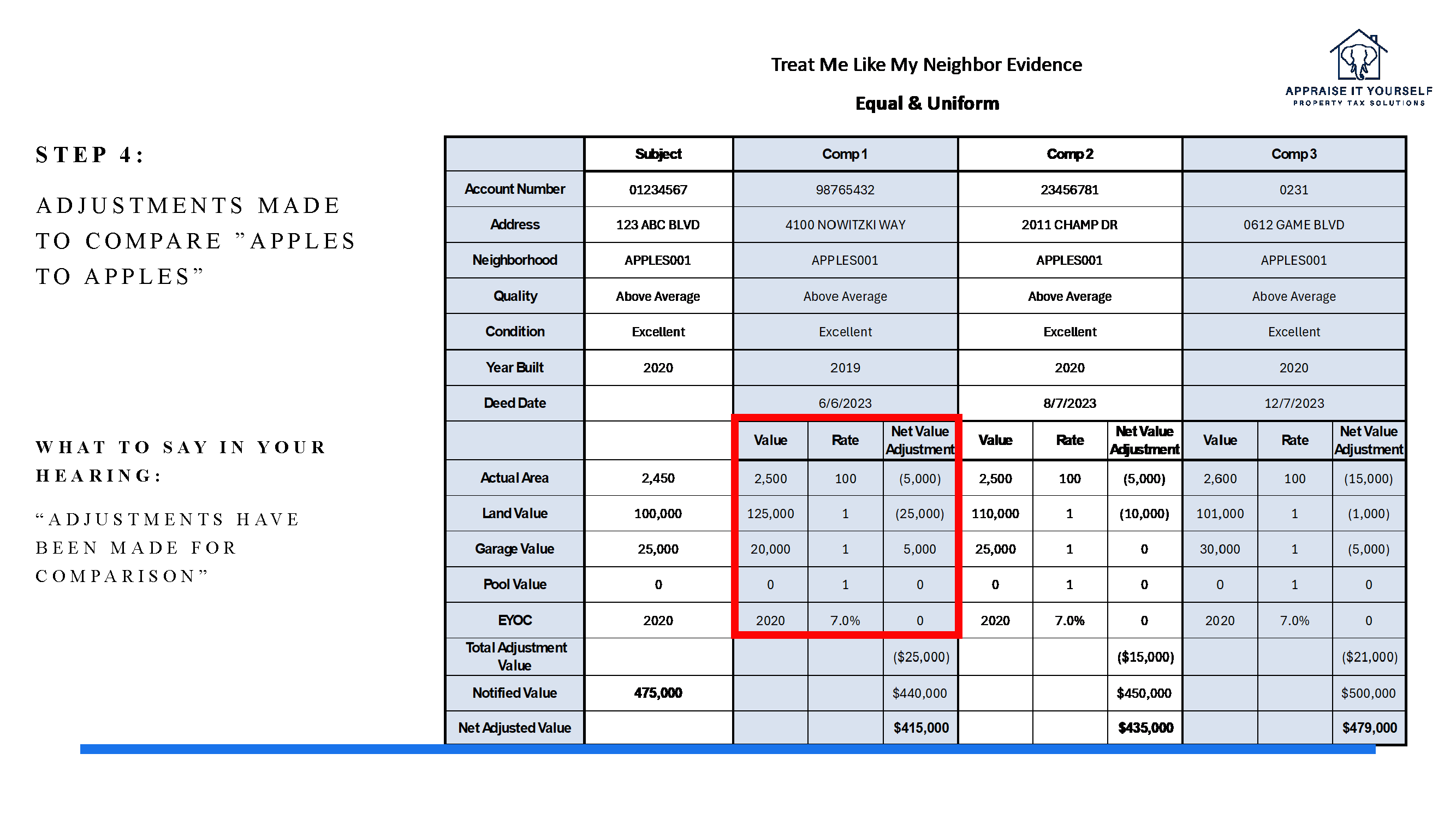

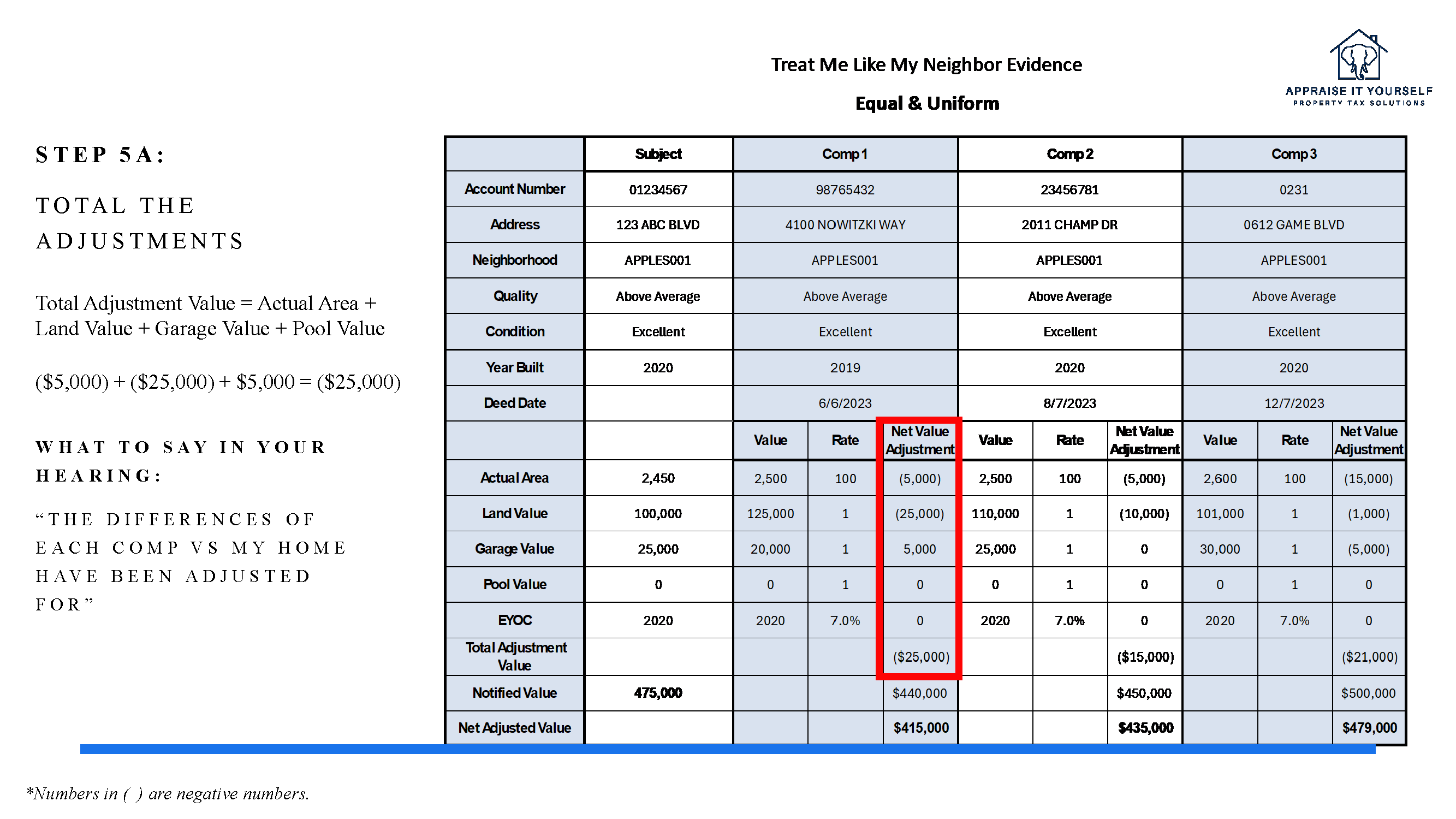

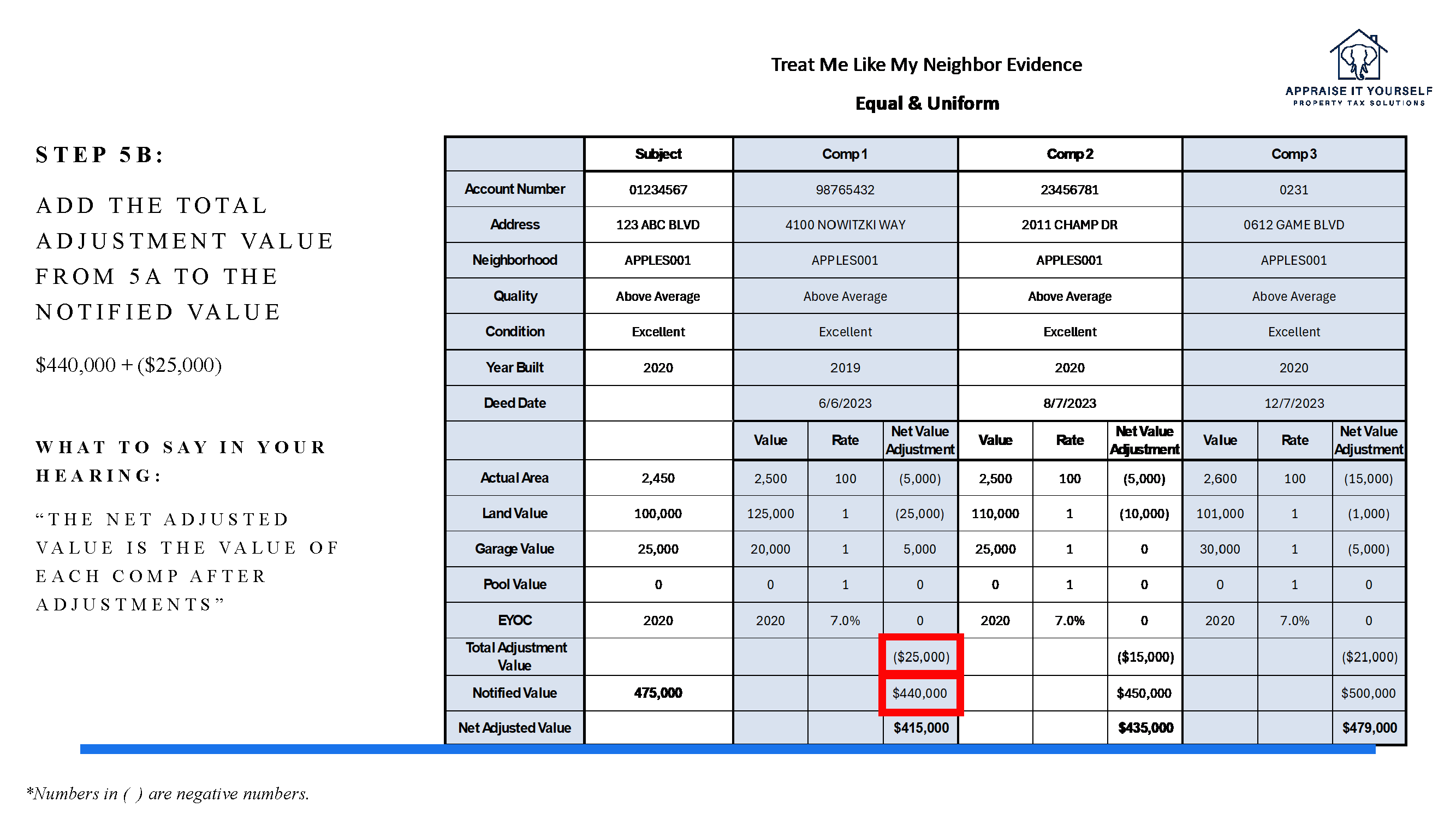

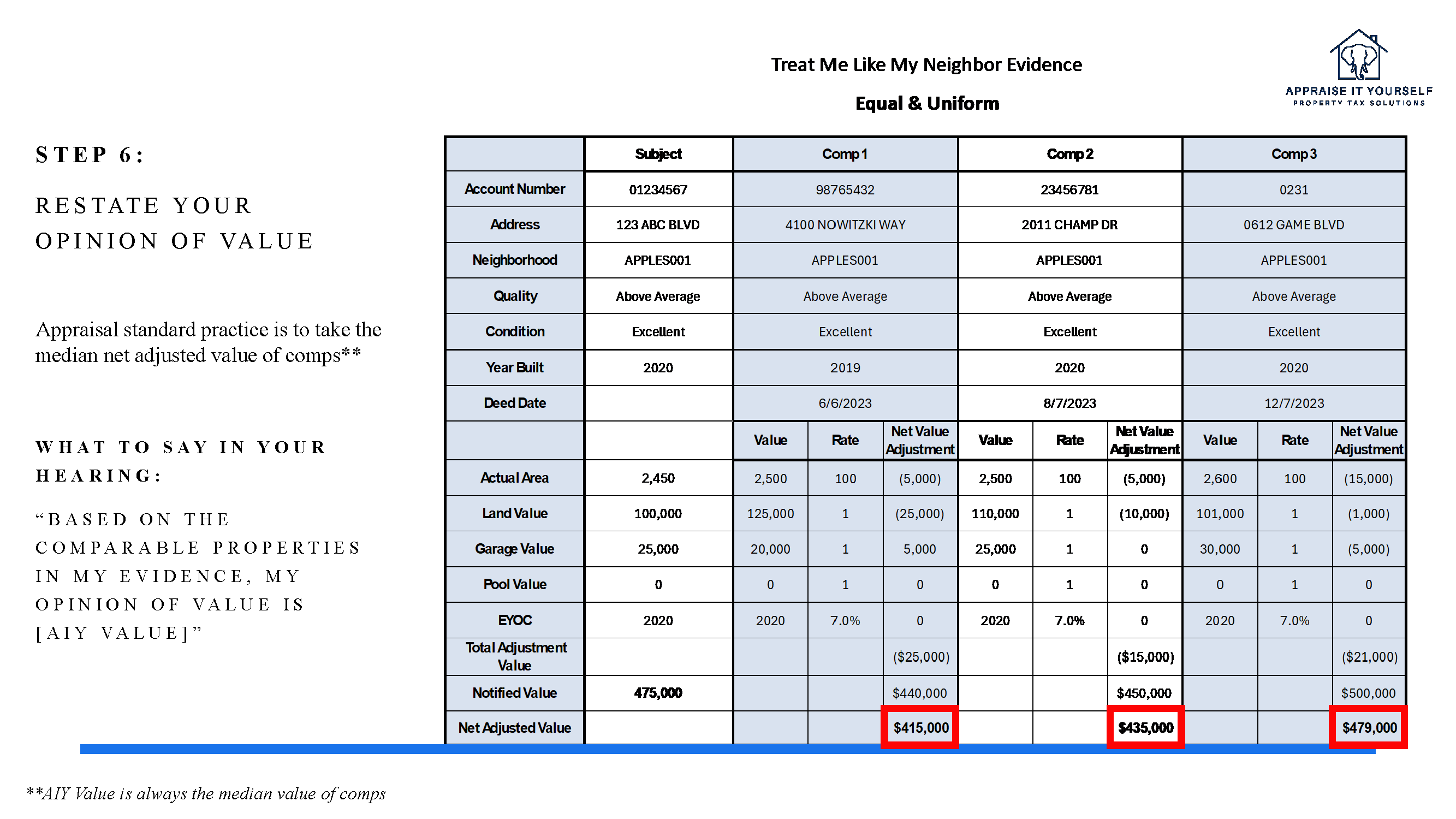

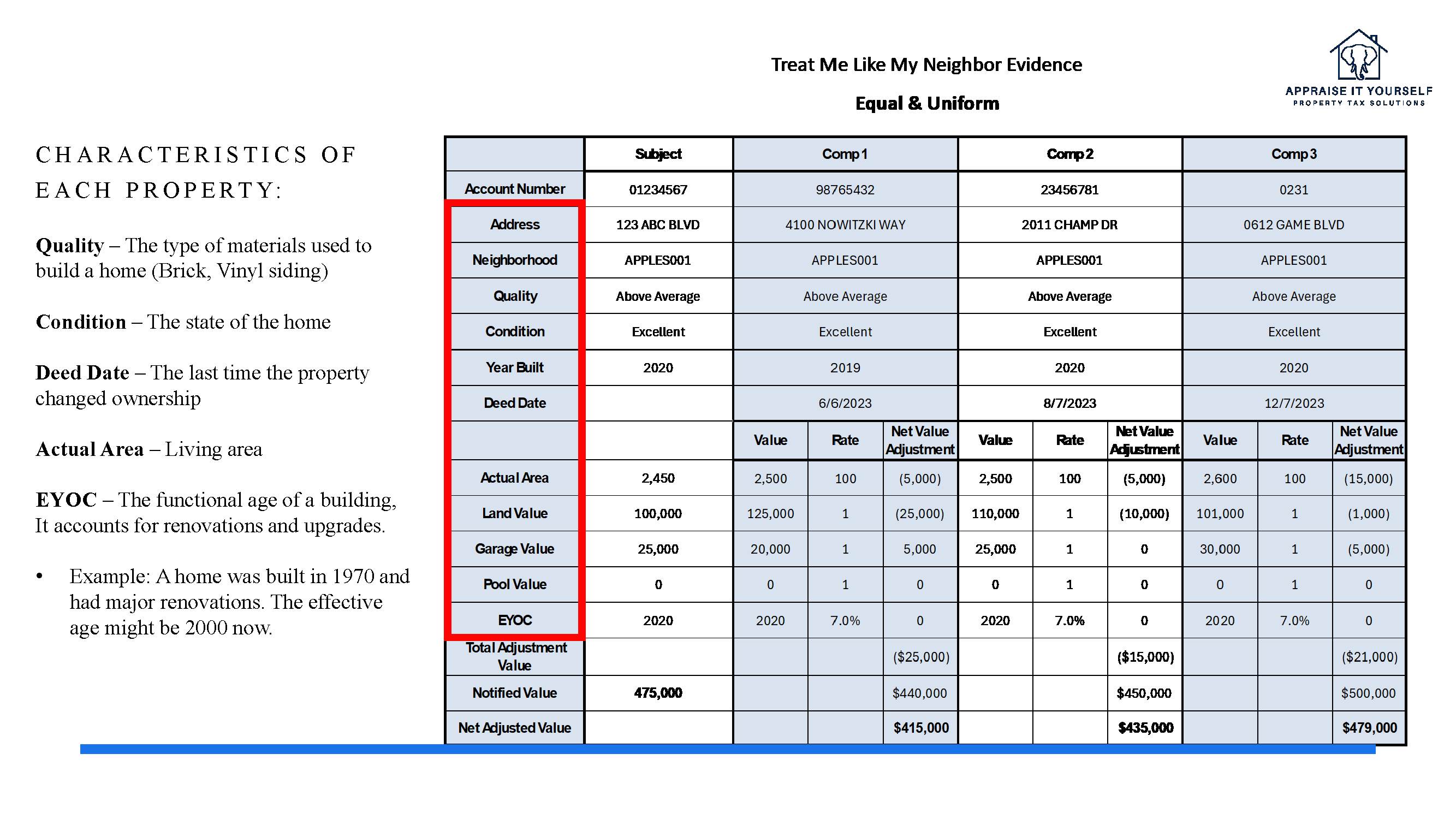

Below is a detailed breakdown of "Treat Me Like My Neighbor" Evidence. While the valuation methods differ, the format remains the same—identical to "Home Value by Sales Evidence."

When is the deadline to appeal my property value?

The typical deadline to appeal is May 15th or 30 days after receiving your appraisal notice, whichever comes later.

How should I present my case in the hearing?

- Present clear, concise evidence to support your claim

- Avoid emotional arguments—the ARB cannot consider personal financial hardship, only property value

- Focus on market-driven evidence rather than personal opinions or complaints about tax rates

- Keep your presentation professional and fact-based

What happens after I file a protest?

An appraiser will reach out to you and potentially offer you a reduced value. If you file your protest through the online portal, you may instantly get offered a reduced value. See next question for further explanation.