How are property taxes calculated?

Appraised Value (also called taxable value) × Tax Rate = Tax Bill

The tax rate is set by local taxing authorities, which include:

- County governments

- School districts (typically the largest portion of property taxes)

- Cities and towns

- Special districts (e.g., hospital, utility, or emergency service districts)

- For details about your specific taxing entities, visit your county tax office website.

What is the structure of an ARB hearing?

- The hearing lasts 15 minutes

- Your case will be reviewed by three ARB members

- You choose who presents first

- Both sides present their evidence

- Instead of explaining why you disagree with the district’s value, simply restate AIY’s evidence:

“Based on the evidence I presented today, the value of my home is [AIY Value]” - Make sure the district’s appraiser visibly shows the property they are referencing

- The ARB may ask questions

- After all questions are answered, the board makes a decision

- You will receive a document (called a "Control Sheet") with the final property value before you leave

What is the difference between market value and appraised value?

Market value is basically the price a home would sell for in a normal situation—where the buyer and seller both agree on the price without any pressure, like a rushed sale or a family discount.

Think of it like selling a used car. If you list your car online, the price you set is based on what similar cars are selling for, how well you have maintained it, and its features. If a buyer is willing to pay that price, that’s the car’s market value.

For homes, market value works the same way. It’s based on recent sales of similar homes, the home’s condition, location, and what buyers in the area are willing to pay. Property taxes are often based on this value because it reflects what the home is actually worth in the current market.

Appraised value (also called taxable value) is the value the local tax office assigns to your home to determine how much property tax you owe.

Do I need to physically be present for my formal hearing?

No, you can participate in the ARB hearing:

- In person

- By telephone or videoconference

- By submitting a written affidavit

Hearing procedures will outline specific requirements for evidence submission, including the number of hard copies.

What if I had an agent last year and I don’t want to use them anymore?

Fill out the Revocation of Appointment of Agent For Property Tax Matters Form and email it to aoa@tad.org

For the form you’ll need to know:

- Owner’s Name and Address

- Agent's Name and Address

- Account number and Address of property

If you can not remember the details about the agent, you can call the Appraisal District and they will give you those details

What should homeowners expect in terms of property taxes for the first three years?

Year 1: You will receive a prorated tax bill, which will likely be the lowest tax bill you will ever have for your home. This bill is based on the number of months you owned the home that year. If you purchased earlier in the year (e.g., April), you will pay property taxes for more months than if you purchased later (e.g., November)

Year 2: Your property tax bill will be based on your home's purchase price, which is considered its Market Value (see our FAQs to learn more). All you need to do is present your closing statement to the district and your done

Year 3: This is the first time you will experience seeing a value for your home greater than the purchase price of your home

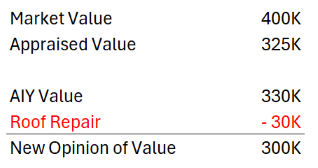

What if my AIY value is not below my initial appraised value?

For customers where the AIY value is not lower than the initial appraised value.

Initial Appraised Value = Last Year Value + 10% (Homestead Exemption)

Every property tax protest is based on market value. If AIY cannot provide a value lower than your appraised value, you may still be able to achieve a reduction. Since market value is the key factor in every protest, AIY serves as a helpful starting point for your argument. To further support your case, additional evidence is essential in securing a lower property value. Simply subtract any estimates from your AIY value to determine your new opinion of value.

How do I request a refund?

Simply send an email to refund@aiypropertyvalue.com with the following information:

Subject: Refund Request (Insert Order Number)

Body of Email: Briefly describe your ARB experience.

Attachment: Include the Controller Sheet (the document you receive after the ARB hearing with the final value decision).

Once received, we will review and process your request.

How can photos help my argument?

Although estimates are helpful, having a photo to support your repair estimate strengthens your case. It provides a visual reference for board members during your hearing.

When should I expect to receive my value notice?

In Texas, property value notices are typically sent out by April 15th or early May.

What should I bring to my hearing?

In addition to bringing your AIY report, you can provide (if applicable):

- Property photographs (showing current condition)

- Receipts or repair estimates

The estimates should be within the last two years.

Simply stating that the appraisal district valued your property incorrectly is not enough—you need to provide evidence to support your claim. AIY customers will be able to upload these supporting documents, the keep all files in one place.

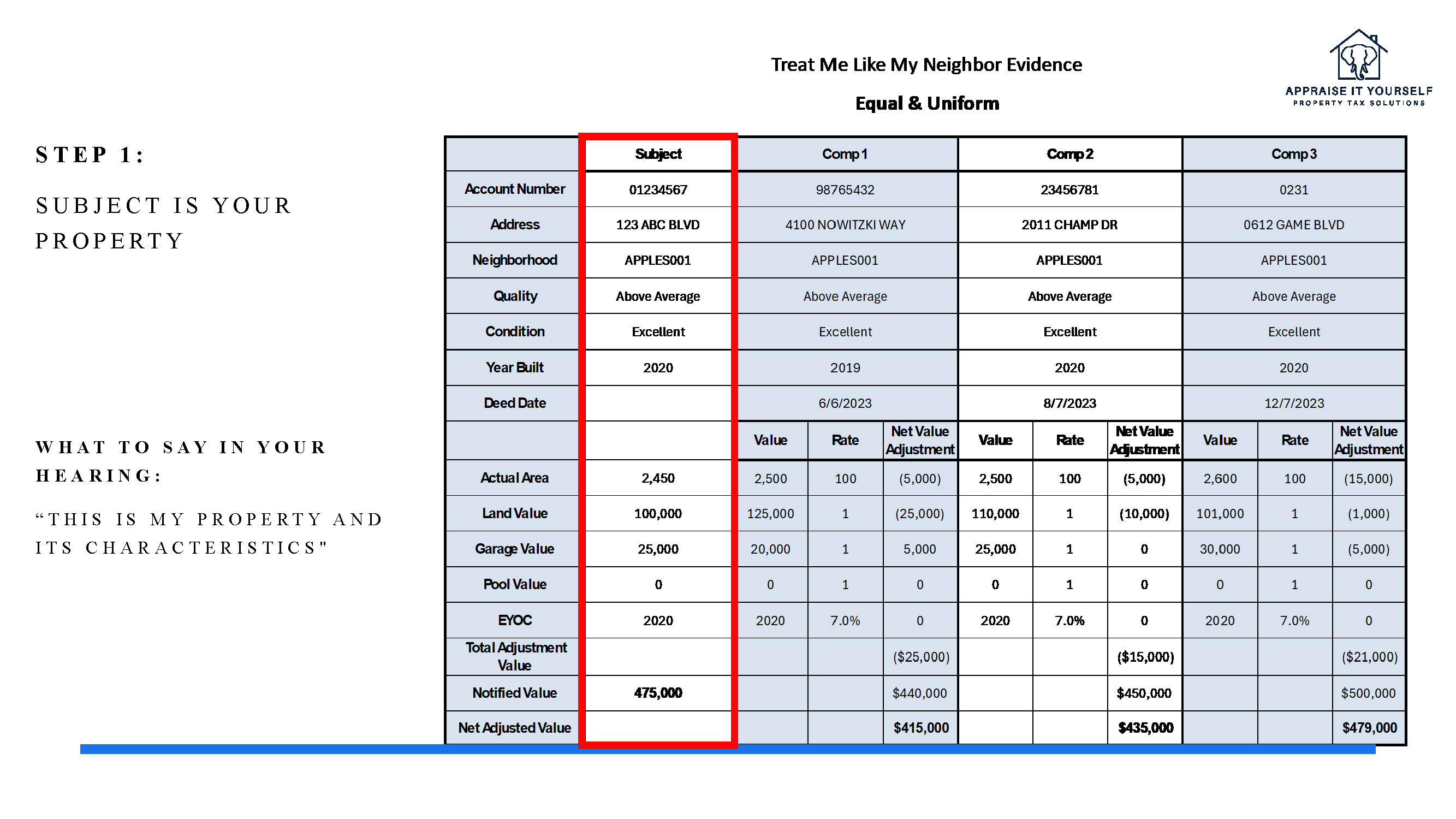

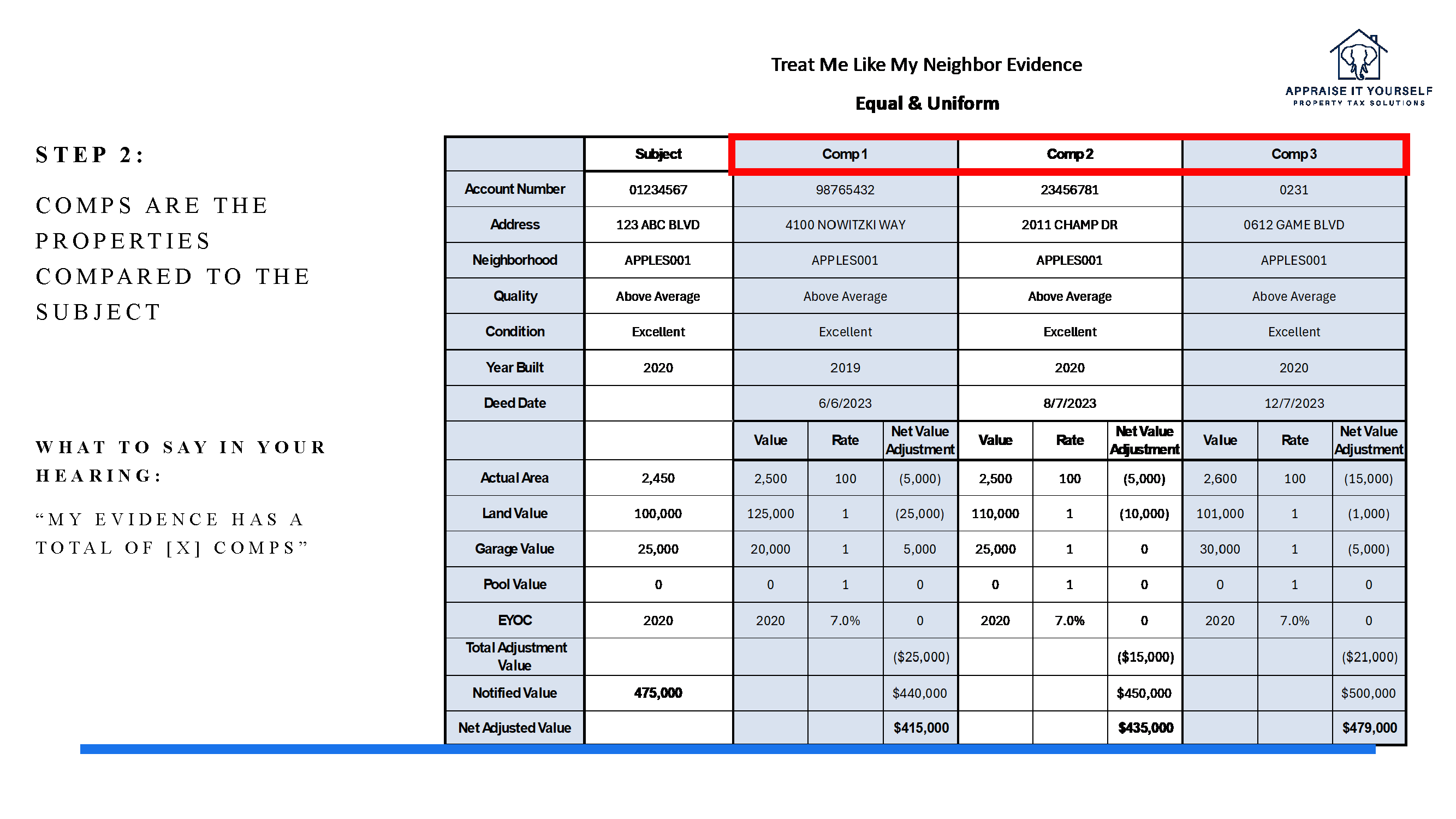

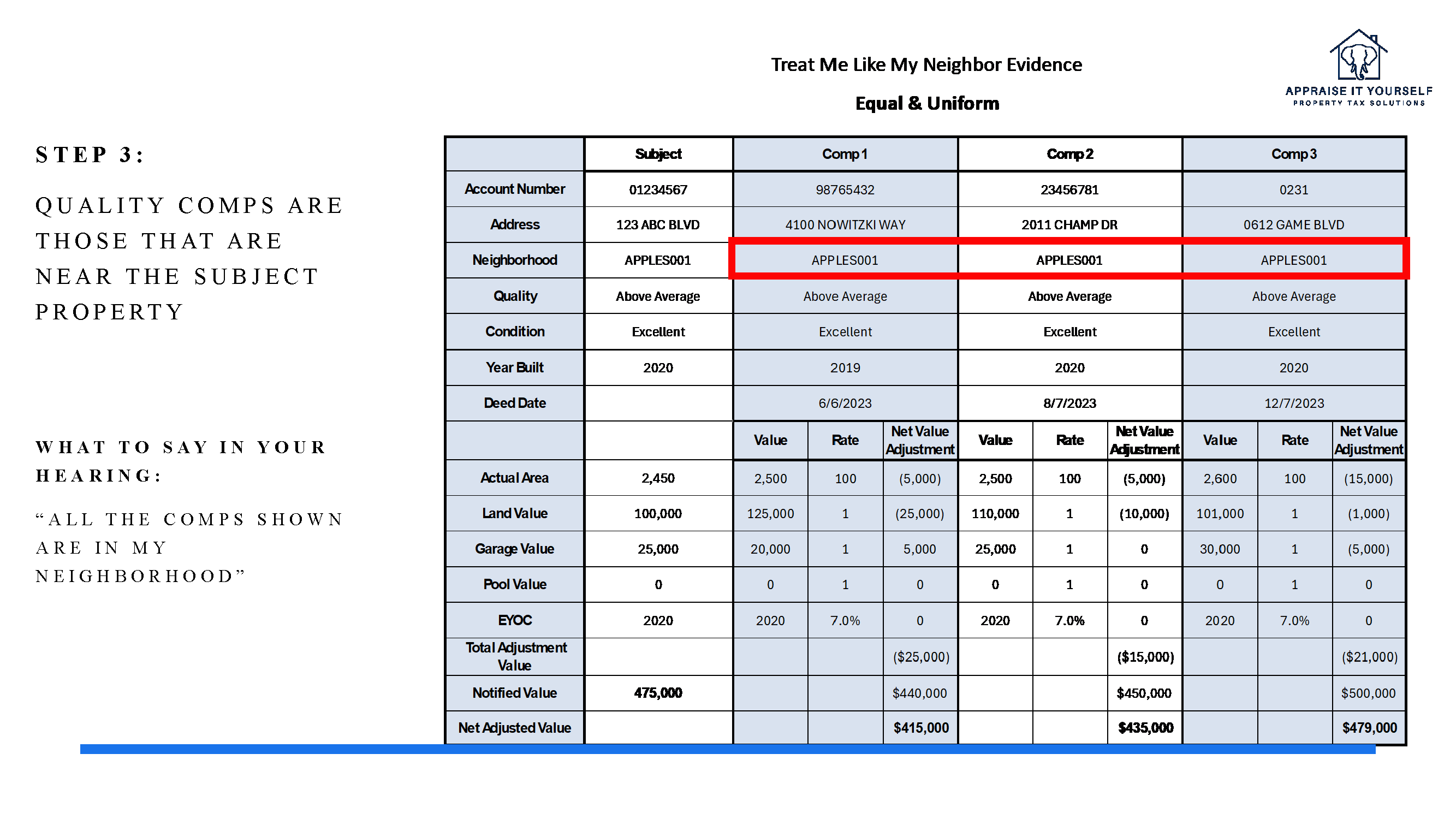

How do I interpret AIY evidence?

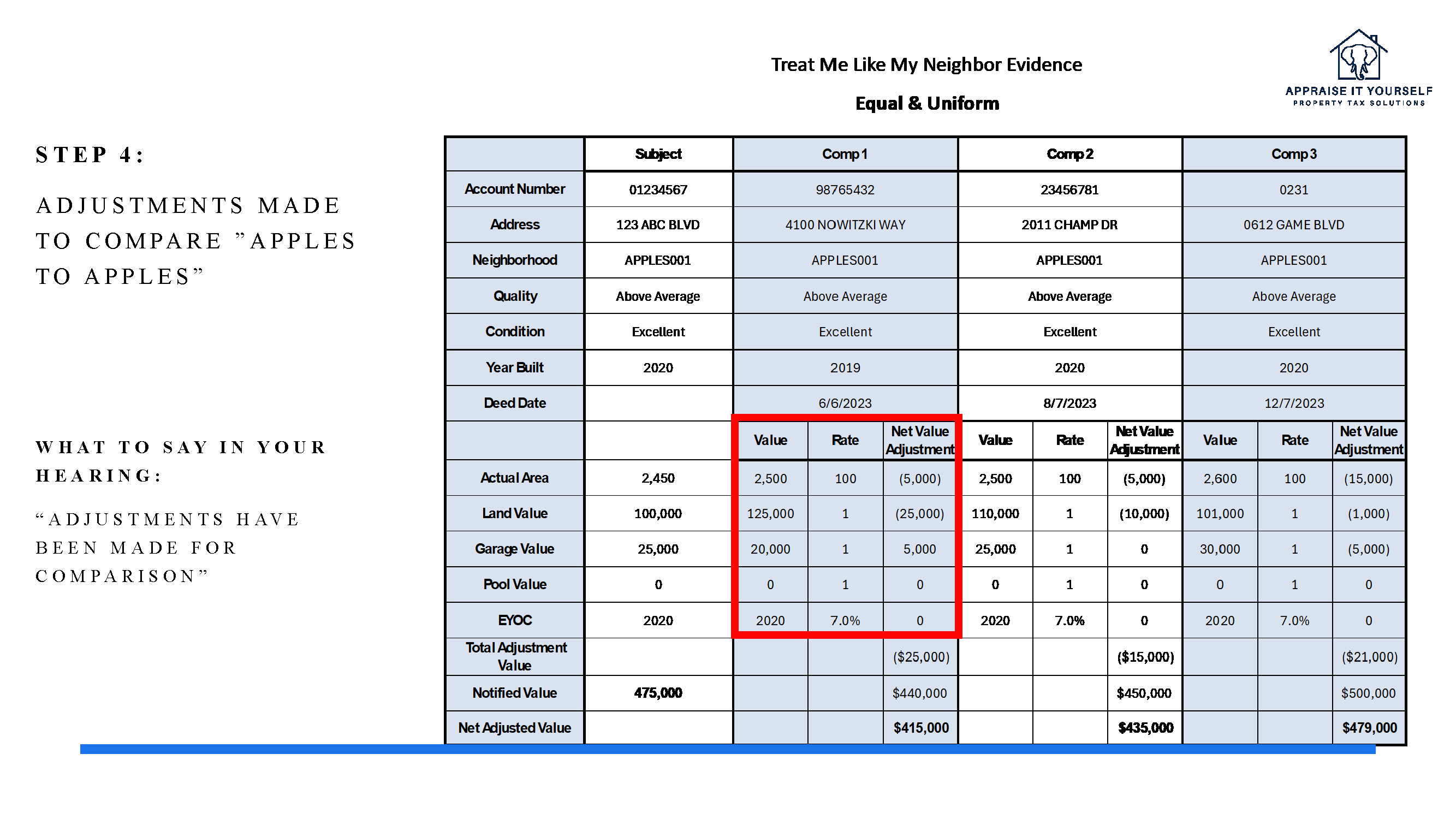

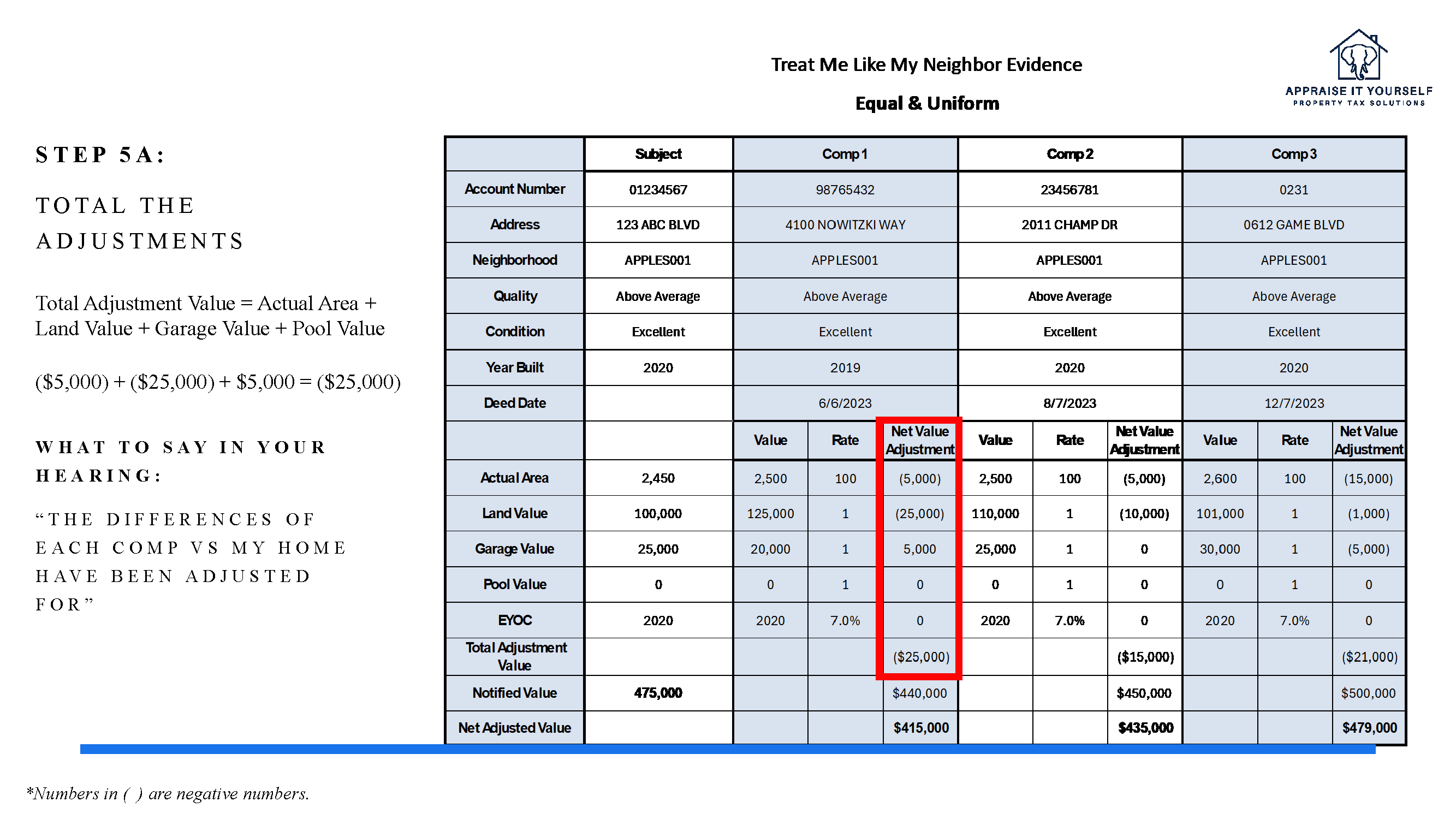

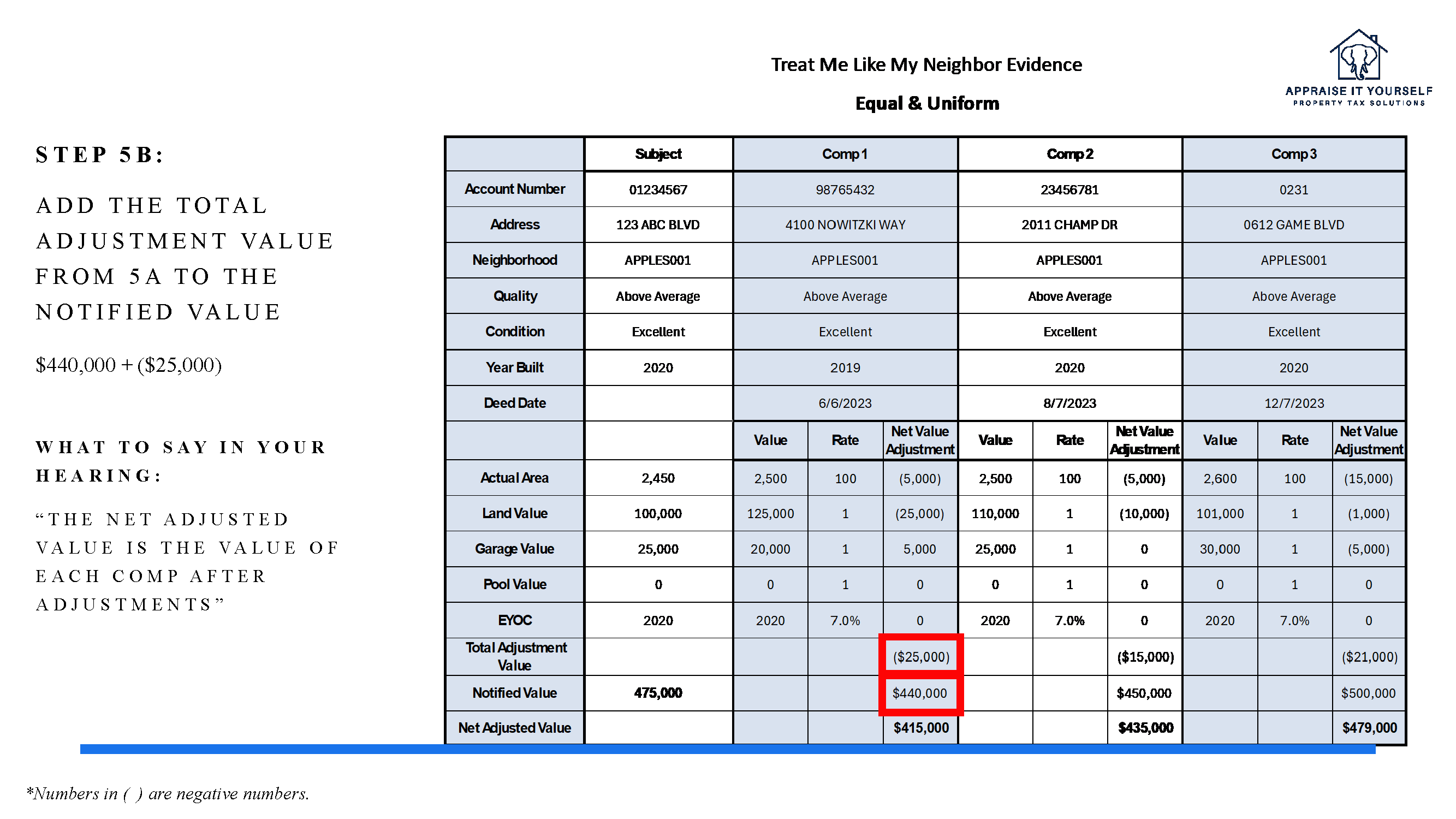

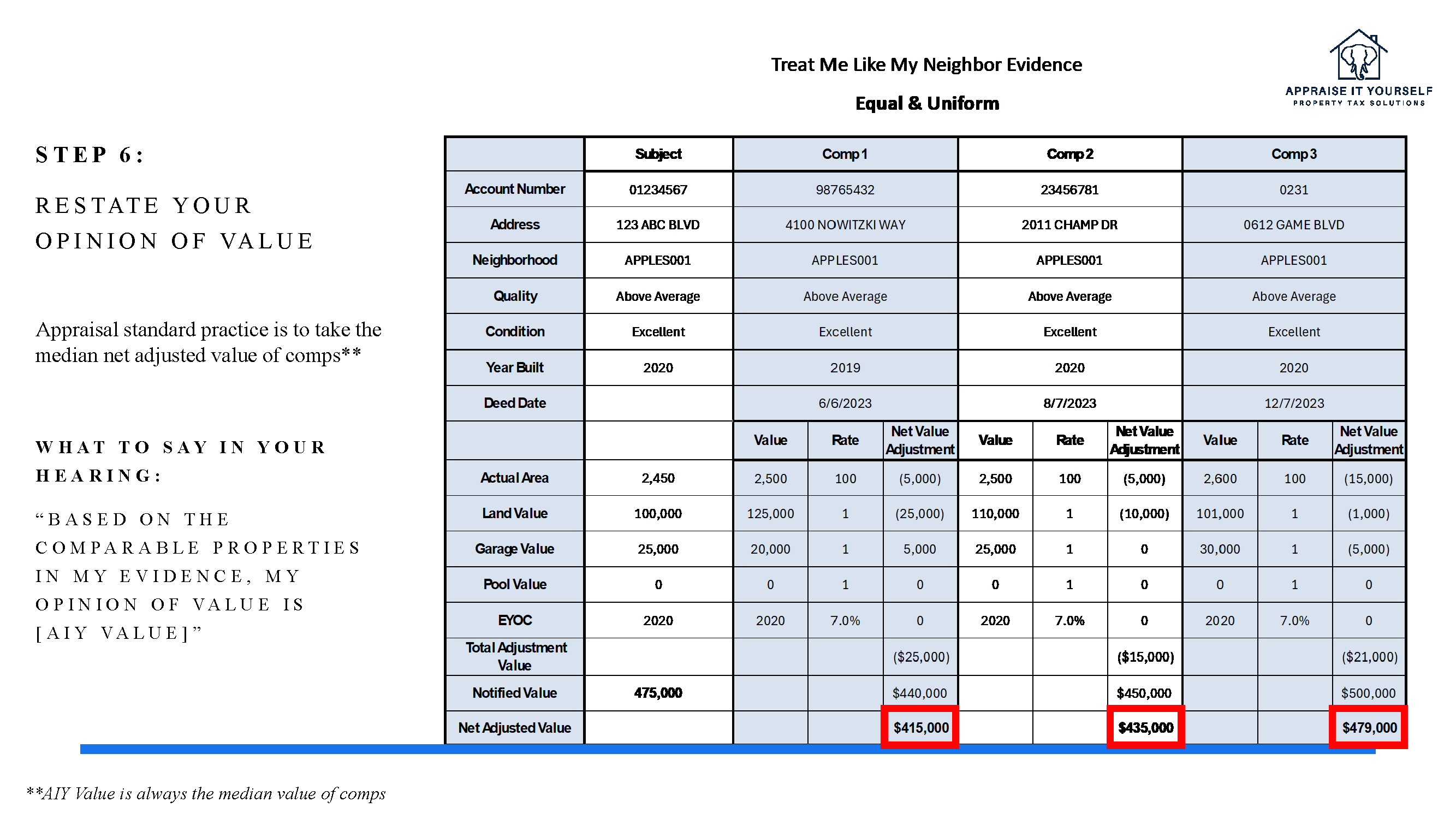

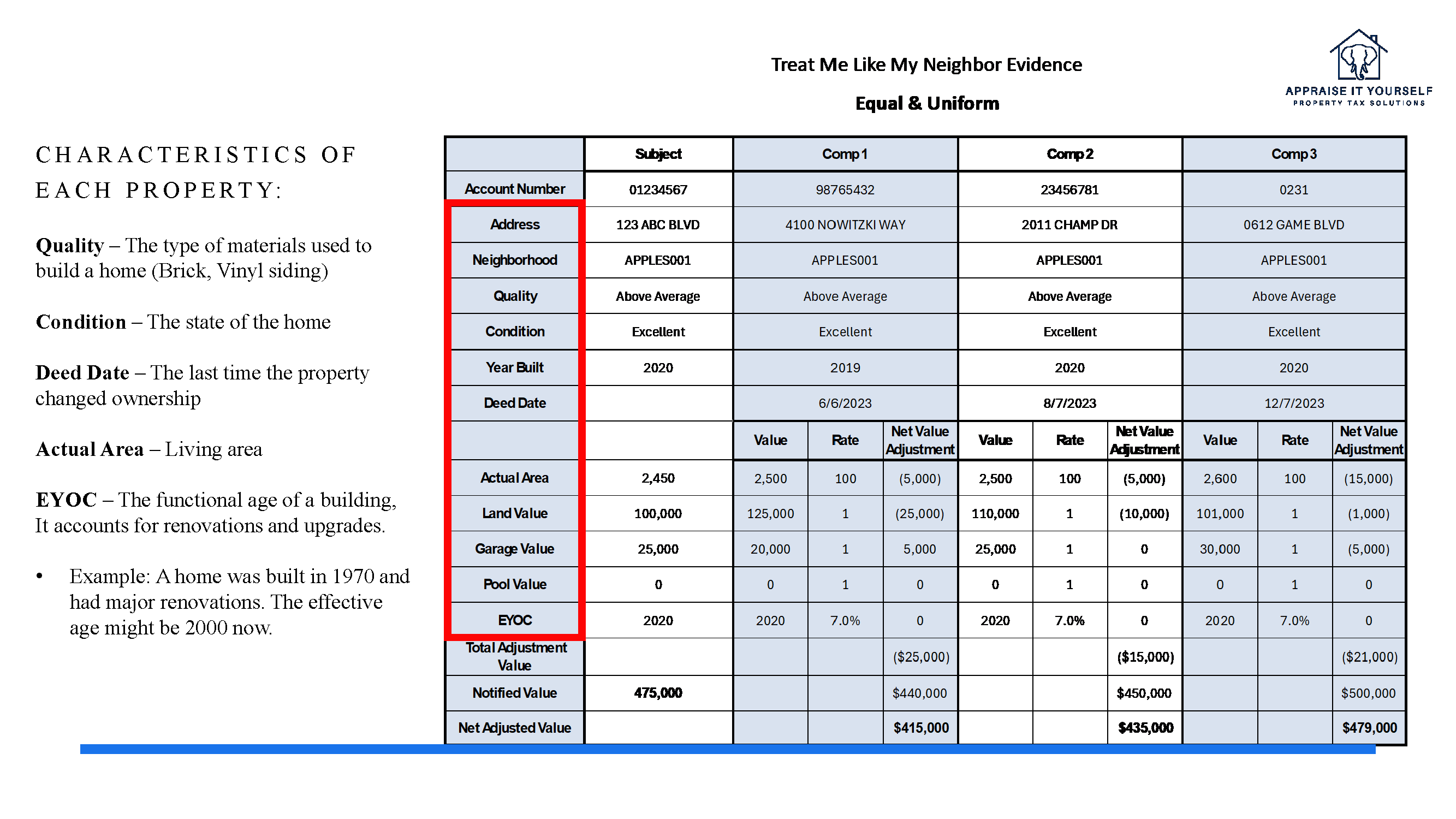

Below is a detailed breakdown of "Treat Me Like My Neighbor" Evidence. While the valuation methods differ, the format remains the same—identical to "Home Value by Sales Evidence."

When is the deadline to appeal my property value?

The typical deadline to appeal is May 15th or 30 days after receiving your appraisal notice, whichever comes later.

How should I present my case in the hearing?

- Present clear, concise evidence to support your claim

- Avoid emotional arguments—the ARB cannot consider personal financial hardship, only property value

- Focus on market-driven evidence rather than personal opinions or complaints about tax rates

- Keep your presentation professional and fact-based

What is the difference between “Treat Me Like My Neighbor Evidence” and “Home Value by Sales Evidence”?

- “Treat Me Like My Neighbor Evidence” compares your home value to other homes in your neighbrohood

- “Home Value by Sales Evidence” compares the sales in your neighborhood to your home

How do I file a protest?

You can file a protest online through the Tarrant Appraisal District website or by mail using the Property Owner's Notice of Protest Form

What happens after I file a protest?

An appraiser will reach out to you and potentially offer you a reduced value. If you file your protest through the online portal, you may instantly get offered a reduced value. See next question for further explanation.

What does Appraise It Yourself Property Tax Solutions do?

At Appraise It Yourself Property Tax Solutions (AIY), we make reducing your property tax bill simple, affordable, and stress-free by doing the hardest part for you.

Think of it like a race: AIY runs the most challenging stretch—gathering the strongest evidence to support lowering your property value. Then, we hand off the evidence to you so you can take the final steps. But you're not on your own—we are also your coach, guiding you through the process to ensure you finish strong.

By empowering you with expert-backed evidence and step-by-step support, we help you save money without sacrificing results.

How do I explain the Home Value by Sales Evidence?

Explaining Market Value—or as AIY calls it, "Home Value by Sales Evidence"—is just as simple. Start by stating your AIY Value, then explain that the comparable properties in your evidence are valid because they:

- In your Neighborhood

- Have the same or similar Quality

- And have fair adjustments made to compare “apples-to-apples”

- Actual Area

- Land Value

- Garage Value

- Pool Value

- Effective Year of Construction

Do I have to accept the district's first value offered?

No, you do not have to accept the district’s offer. They typically make one informal offer as a way to reduce the number of hearings they have to attend. If you do not accept their new proposed value, your appeal will move forward to the Appraisal Review Board (ARB) hearing.

How do I explain the Treat Me Like My Neighbor Evidence?

Explaining Equal & Uniform—or as AIY calls it, "Treat Me Like My Neighbor Evidence"—is simple. Just state your AIY Value and explain that the comparable properties in your evidence are valid because they are:

- In your Neighborhood

- Have the same or similar Quality

- And have fair adjustments made to compare “apples-to-apples”

- Actual Area

- Land Value

- Garage Value

- Pool Value

- Effective Year of Construction

How do I check out with multiple properties?

- Search for your address

- Once you confirm it is the correct address, add it to your cart

- Enter your next address and click “See My Savings”

- Once you confirm it is the correct address, add it to your cart

- Repeat as many times as needed

- Once completed, go to your cart in the top right corner of the page to check out

What happens before my formal ARB hearing?

You will receive a notice of your hearing at least 15 days in advance, detailing the date, time, place, and subject

At least 14 days before the hearing, you will receive:

- ARB hearing procedures

- A statement advising you that you can request the evidence the appraisal district will use. AIY customers do not need to worry about requesting evidence. Our evidence is strong enough for you to skip this step.